Is the cleantech market overheating?

As a boy growing up in Australia, we were used to hot summers. By Nordic standards it was hot all the year round. A cold winters day might be 10°C, but 16-18°C was more likely. A far cry from Nordic winters (although weather events this week are possibly shifting the dial, with northern Europe in the grip of a winter heatwave). Summers were altogether different. January days under 30°C were a disappointment, and when then land really heated it, it got up towards 40°C. Sometimes it touched the low 40s. When it did, the weather map was coloured red.

Nowadays 40°C isn’t considered that hot. You’d expect several days like that in a summer. And, like in 2019, when the interior of the country just heats up and up, the temperature hovers in the mid-40s. The meteorologists needed a new colour, so they introduced purple to colour the map on such days.

Your Mundus Nordic Green correspondent has been involved in the clean energy market for over 15 years. There’s been some times when the market was hot. But mainly its been cool. In fact, for most of the last decade the map of climate action has been coloured blue (proverbially). That changed with the corona pandemic, and the desire in Europe to build back better. In a very short time the figurative map of business' climate activity moved through blue to green, onto yellow and then red. In February it hit purple.

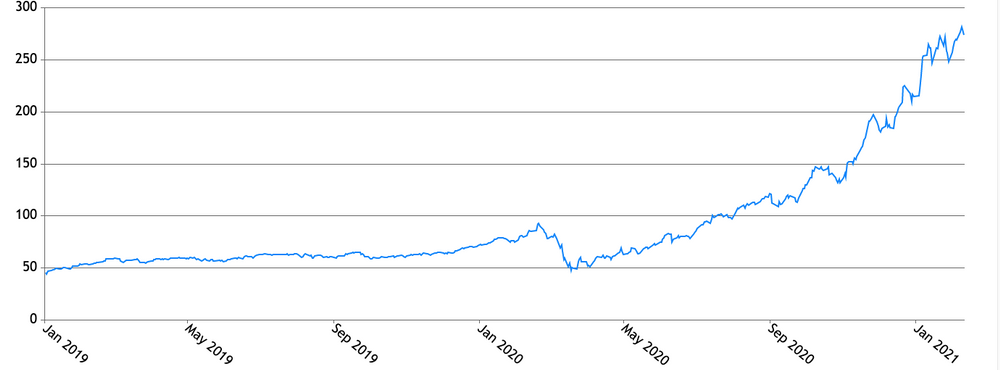

There isn’t any single measure to use to shade the map. But there are a number of indicators that all point in the same direction. The chart above of the WilderHill Clean Energy Index is one fair indicator. Over the last two years it moved, or did not move, horizontally from January 2019 to June 2020. In August it started to move up, and by last October it had doubled its average over the proceeding year. Between October and January it almost doubled again. If we had shown the same graph over a longer period of time the trend would have been even more pronounced. In fact the index was horizontal for the entire decade 2009-2019.

Another measure would be the number of references to clean technology terms in the media in each Nordic country. Mundus tracks this –we use this information to compile our daily Mundus Nordic Green News. In mid last year Sweden was averaging around 200 references each day. In January it averaged 300 per day. In February it hit over 500 each day. The media companies have certainly noticed this trend and are beginning to cover climate issues more seriously.

Turning to the title of this article. Is the market for cleantech and renewable companies overheating. There are two schools of thought on this. Cleantech optimists point to the massive challenge that the world faces if it is to avoid the worst effects of climate change. In this view, from an industrial perspective we have barely scratched the surface in terms of technologies, companies and industries that need to be created to decarbonise the economy. The pessimists look at the valuation of the listed companies, eg the ones on the WilderHill Index and observe that it will be hard for a new investor to ever recoup the value of their investment from underlying earnings and dividends.

Can both views be correct at the same time? Actually, yes. It is possible to believe that the current market is completely overvalued, and at the same time agree that trillions more (in whatever your currency) will be spent on climate. This can be possible, even quite likely if you think about all the firms that are yet to be created. Just like asking in the 1980s, whether it would be Ford, GM or Toyota that would be the biggest car company in 2021. Elon Musk hadn’t even hit puberty.

There are some very frothy indicators in the Nordic capital markets. The Oslo Bourse has seen multiple listings and capital raisings of hydrogen companies in the last few months. Many of these companies that are now heralded as potential future champions were quite small affairs only 12 months ago. This week for instance, Nel Hydrogen, which makes electrolysers raised another NOK 1.3 billion in just one day, based upon the outlook that it presented of phenomenal growth in the market. But, it is a reasonable question to ask “do they have the technologies, human talent and wherewithal to deliver on their promise?”

Another category are the corporate plays. The Aker Group restructured just 6 months ago, spinning out carbon capture and renewables businesses. Billions of NOK in value was created almost overnight. Then to underline the power of good stories on financial markets Aker Horizons, one of the new daughter companies announced that it would be listing Aker Clean Hydrogen, a pure-play industrial clean hydrogen producer, just 3 weeks after Aker Horizons was itself listed (see Mundus Nordic Green News on 19 February). That is a fast move by any measure.

In addition to the financial plays, February has also seen some fantastic technological events. Denmark’s politicians agreed a plan to build a new island in the North Sea as a home for 650 giant windmills - almost as high as the Eiffel Tower (5 February). But perhaps the most unexpected and boldest announcement came this week from a completely new player H2 Green Steel, backed by a leading Swedish VC, and two of Sweden’s hottest tech names – Daniel Ek and Cristina Stenbeck (23 February). H2 Green Steel is planning to use relatively unproven technology to make carbon-free steel via a new process that requires a dramatic scale up in the amount of windpower produced in Sweden. It is a bold undertaking, that will certainly stretch the abilities of all involved. To lead the initiative, H2 Green Steel has poached one of Sweden’s top industrialists, Henrik Henriksson, from his relatively safe job at Scania. Perhaps this insurgent has the ability to transform the steel industry as Musk has done for cars. The anaology was well-understood by VC Harald Mix, who claimed “We will be the industry's Tesla”.

So, to answer the question – is the market overheating? Even if right now the market is red purple hot, it is impossible to know what will happen next. Just as climate change demanded that meteorologists move to the colour purple, there is still the potential for it to heat up again. What colour will the map be then?

But then again, political and market segments are driven by momentum. A cool change could blow through and wipe away billions in value. It has happened before. Your correspondent remembers …

About Nordic Green News

The Nordic countries are some of the most dynamic and successful economies in the world. They are also leaders in sustainability, from renewable energy, biofuels, carbon capture and storage and the hydrogen economy, circular economy business models and battery development, the Nordics are pioneers in policy design, technology development and consumer uptake. Mundus Nordic Green News is covering this transition for the international community. Every day we clip the stories of most relevance to international businesspeople and policy experts from the flow of news. We supplement these with our own opinion pieces and commentary, in English.